Taking industry trends into consideration is imperative as you make decisions about your benefits package for the next year. Keeping up with trends can help business leaders compete with other employers, making it easier to attract and retain top talent. In some cases – like wellness and mental health benefits – keeping up with trends can help you prevent illness and absenteeism and capture cost savings.

It’s also critical to look through the lens of the pandemic, which has changed what’s available to employers and what employees expect. While you may have been able to renew your contracts without major changes year after year pre-pandemic, COVID-19 has changed that. We’re seeing trends around remote work benefits, mental health, and more as a result.

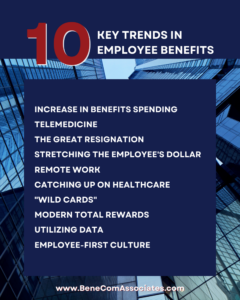

With that, let’s dive into the employee benefit trends we expect to see throughout 2023 and into 2024.

Both employers and employees will invest more in benefits than ever before due to two primary factors: increasing demand for expanded benefits and the rising cost of care.

First, the expanded benefits we’re seeing typically address wellness and mental/behavioral health issues and include things like expanded employee assistance programs and mental health support. While these benefits require an investment upfront, they typically provide a high return on investment. Second, the rising cost of care is multifaceted and related to increasing labor and supply costs, among other reasons.

Clear, effective communication of benefits is crucial in managing and reducing costs. It empowers employees to make benefit selections that make the most sense for their situations, reduces or eliminates miscommunications, and drives retention – reducing the costs associated with turnover.

The demand for telemedicine will continue indefinitely. Telemedicine refers to the use of technology to provide healthcare services from a distance. It allows doctors and patients to communicate and share information electronically, without the need for an in-person visit, through video calls, remote monitoring of vital signs, and electronic health records. Telemedicine is becoming more popular because it’s convenient and improves access to healthcare services, especially for those who are disabled, who lack access to transportation, or who live far away from medical facilities.

More patients are seeking telehealth visits, which means that more employees are seeking health plans that cover these services. However, telemedicine does come with some disadvantages. For employees, remote medical visits can lack the connection that comes with face-to-face care. Additionally, some components of a physical exam can’t be performed without an in-person visit. For employers, there is a risk that employees may be addressing their healthcare needs during their workday, compromising privacy and productivity.

Unfortunately, the Great Resignation isn’t over. You can expect to see workers entertain offers from competitors and will need to continue to strategize to retain your workforce in this environment.

The reasons behind the Great Resignation are complex and multifaceted. In this post-pandemic world, even satisfied employees reevaluate their priorities and values, with many choosing to leave their jobs in search of better work-life balance, improved mental health, or more meaningful work. Additionally, some employees have experienced burnout or frustration with their employer’s response to the pandemic, such as inadequate safety measures or inflexible work arrangements.

The Great Resignation has been particularly challenging for employers, who are struggling to retain talent and maintain business operations amid staffing shortages. To address this issue, employers are implementing new strategies to improve employee engagement, like offering more competitive benefits packages, flexible work arrangements, and opportunities for professional development.

In the next year, healthcare affordability will trend upward. Employees will continue to seek out benefits that help them stretch their dollars and make ends meet at home, like health savings accounts (HSAs).

A Health Savings Account (HSA) is a tax-advantaged savings account available to employees covered by a high-deductible health plan (HDHP) and designed to help pay for qualified medical expenses. Contributions to an HSA are tax-deductible, and the funds in the account can be used to pay for qualified medical expenses – like deductibles, copayments, and coinsurance – tax-free.

Health Savings Accounts (HSAs) can be beneficial for both employees and employers. For employees, HSAs reduce taxable income, lower out-of-pocket costs, allow them to save for future medical expenses, and carry over from one employer to the next. For employers, HSAs reduce costs, improve employee retention, offer tax benefits, and improve employee health outcomes.

It’s no secret that there are more remote workers today than ever before, even if the reported percentage of workers who are remote varies depending on the source of the recent survey and the definition of “remote work”.

Now that some or all of your employees are working from their living rooms, transparency around remote work policies has become essential. Employees working from home have a strong desire to know what you expect of them when it comes to work hours, availability, communication, productivity, engagement, and more. Clear communication helps your remote employees meet and exceed your expectations, building trust and driving individual and organizational success.

The COVID-19 pandemic caused many people to delay or cancel routine healthcare maintenance, such as annual physicals, dental check-ups, and preventive screenings. As a result, one trend in the employee benefits industry is a focus on helping employees catch up on these missed appointments and screenings.

For employers, the impact of neglected mental and physical health is multifold:

HR leaders can help mitigate these impacts by promoting the importance of personal healthcare and offering comprehensive healthcare benefits to their employees.

“Wild card” employee benefits are creative, voluntary benefits that aren’t typically offered by employers, but can be used to set an organization apart from its competitors and increase employee satisfaction. Many of the benefits that fall in this category are low-cost or free for employers but still add value for employees. Some of the wild card benefits you might consider include:

Researching the newest or most innovative benefits frequently can help you offer the most alluring benefits and stay ahead of your competition.

Total rewards programs are pay and benefits packages that employers offer to employees in exchange for their contributions to the company. These programs include a wide range of rewards and benefits beyond just wages, like health insurance, retirement plans, paid time off, bonuses, stock options, and other non-monetary benefits. The goal of total rewards programs is to attract, motivate, retain, and engage employees, and to create a work culture that supports employee well-being and development.

Employees will continue to expect a modern total rewards program, which means modernization should be incorporated into your strategy. Modernizing total benefits refers to the process of updating and improving your benefits package to better meet the needs and preferences of modern workers. This can include expanding your benefits beyond traditional plans and leveraging technology to improve accessibility and delivery.

By modernizing total benefits, you can attract and retain top talent, improve employee engagement and satisfaction, and support the overall well-being of your workforce.

The trend toward data visualization and business analytics continues upward. Leveraging data can help you tailor better benefit plans by providing insights into employee needs and preferences, usage patterns, and the overall effectiveness of benefit programs. This might include analyzing benefit plan usage to understand where to invest in the prevention or comparing your current offerings to industry benchmarks to identify gaps.

Leveraging data can help you design more effective and relevant benefit plans that meet the changing needs and preferences of your people – so you can put your dollars where they’ll have the greatest impact.

Employee-first cultures are on the rise, and employees continue to seek out employers who practice what they preach in this arena.

Employee engagement is perhaps the most crucial metric in any organization as it drives every other KPI, from the bottom line to customer satisfaction. Developing an employee-first culture is foundational to building an engaged workforce. In order to develop an employee-first culture, you should prioritize initiatives that support employee development and well-being and communicate them clearly and adequately. These steps will help you establish your brand as a company with an employee-first culture.

As you plan out your offerings for FY24, consider leveraging a benefits communication provider like BeneCom Associates. Our team provides specialized expertise, resources, and support to improve the effectiveness of your communication strategies. We can assist with a variety of channels to offer the most comprehensive communication of open enrollment, benefit statements, wellness programs, newsletters, and more.

If you’re looking to improve the effectiveness of your employee benefits communication strategy, BeneCom Associates has you covered. Contact us today to learn more about our offerings.